You will find real estate agents in every market in the country: from the poorest, low-cost area to the highest priced, most ritzy enclave. If the “average agent” in all these markets had roughly the same number of closings per year, that would have some pretty significant implications: the agents in Beverly Hills would be fabulously rich while those working in the inner city would be struggling to feed themselves. And yet, despite the reality TV shows, there doesn’t seem to be this kind of income disparity in agents around the country.

According to the US Bureau of Labor Statistics, the median real estate agent made $47,000 in 2017 (1). Do agents around the country close wildly different dollar volumes or is there a relationship between average sale price and productivity?

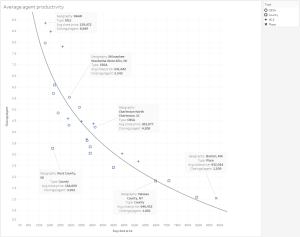

We took a look at the average agent productivity (closed sides per agent) in a variety of different geographies and plotted it against the average closed price in that geography. We looked at CBSA (core-based statistical areas – cities with their suburbs), places (cities), counties, and MLS’s. The results give a definitive answer to our question:

There is a direct and obvious relationship between the average closing size and the number of deals an agent does in that market. In fact, the average closed volume per agent is remarkably consistent from market to market in a range of around $1M -$1.4M. Agents in the highest cost market profiled, Boston, closed on average just barely over 1 side per year while those in the lowest cost geography, the Rockford Illinois Area Realtors Association MLS, closed over 8. At the end of the year, those agents closed about the same dollar amount! This suggests that the real estate agent culture in those two places is very different. We’ll explore that in future posts.

The data also suggest to me that the law of supply and demand applies to agents – you pay more for “real estate agent services” you get more “real estate agent services providers”. The barrier to entry in our business is low enough that people will enter the business at a rate sufficient to drive down the productivity number to a minimally sustainable level.

Remember that these are the averages: most full-time professionals will greatly outperform these and most professionally-run companies will insist on a higher threshold to continue working in the business. Nevertheless, the pace of closings for agents is highly dependent on where they work.

(1) Assuming 5.7% commission split at 75/25, 50% to each side, that would imply around $2.2M in production which (in my humble opinion) seems a bit heavy based on the actual numbers. Perhaps many low-producing agents are considered part-time and not counted in the wage survey.