Download the Report Here

Relitix’s Agent Movement Index™ Closes 2025 With Ongoing Weakness in Agent Mobility, Though Regional Divergence Emerges

LAKE GENEVA, WI – JANUARY 30, 2026 — Relitix’s latest release of the Agent Movement Index™ (AMI) through fourth quarter 2025 confirms that the subdued agent mobility environment persisted through year-end, although significant regional variations have emerged. While national metrics remained below historical norms, the Midwest continues to outperform other regions, while the South and West experienced more pronounced declines..

KEY OBSERVATIONS FROM 4Q 2025:

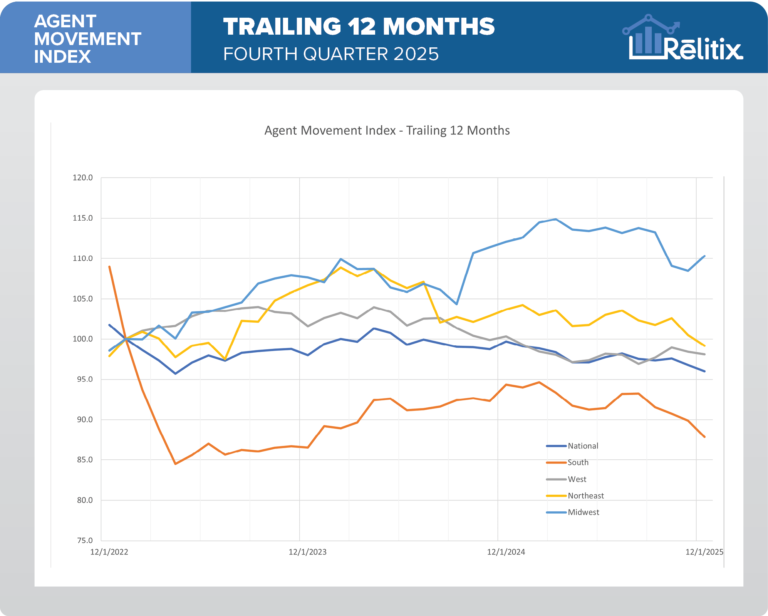

- National Trailing 12-Month Score Continues Decline – The national trailing 12-month AMI ended December at 96.0, extending the downward trend observed throughout 2024 and into 2025. This metric has now remained below the 100 baseline for over a year, signaling sustained weakness in agent movement.

- Regional Divergence Becomes More Pronounced – The Midwest continues to significantly outperform other regions with a trailing 12-month score of 110.3, indicating relatively robust agent movement activity. In contrast, the South has dropped to 98.1, the West to 87.9, and the Northeast to 99.1—all reflecting varied market conditions across the country.

- December Shows Typical Year-End Softness – The monthly AMI value for December registered at 65.4, consistent with the seasonal pattern of reduced activity during the holiday period. The seasonally adjusted figure of 95.6 suggests the underlying trend remains below historical norms.

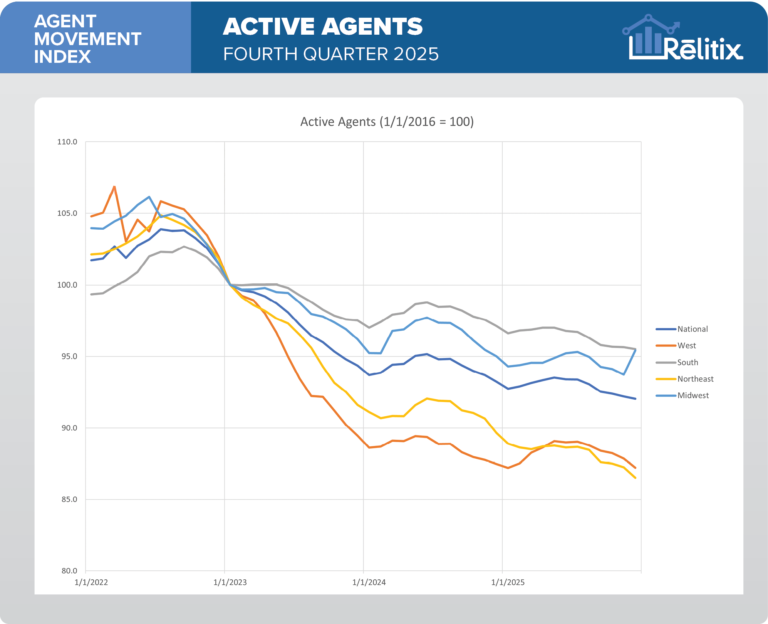

- Active Agent Pool Continues Gradual Erosion – The national active agent index—measuring agents closing at least one transaction in the past year—finished December at 92.0, down from the 2021-2022 peaks. All regions experienced declines, with the West and Northeast seeing the steepest drops to 87.2 and 86.5 respectively.

REGIONAL HIGHLIGHTS:

- Midwest – still leading the pack. Agent transfers remain most active here, supported by resilient transaction flow and a balanced mix of independent and franchise firms. Recruiters are finding receptive audiences where productivity tools and lead programs are strong differentiators.

- South – cooling from its post-pandemic strength. After two years as a highly mobile region, southern markets have settled into a slower pace. Increasingly agents are opting to stay put, placing pressure on recruiting programs.

- Northeast – stable but selective. Agent movement has flattened, and recruiting wins increasingly hinge on firm culture, compliance clarity, and support for buyer-side transitions.

- West – edging off the bottom. Following steep declines in 2023, mobility has ticked up slightly but remains significantly lower than the post-pandemic era. Brokerages here are focusing on high-producing agents and targeted outreach rather than broad campaigns.

LOOKING AHEAD TO 2026:

Brokerage leaders should anticipate:

- Continued Regional Variation – The divergence observed in 2025 is likely to persist, requiring market-specific strategies rather than one-size-fits-all approaches to recruitment.

- Potential for Stabilization – With the industry now more than a year past the NAR settlement implementation, there are tentative signs that the disruption to normal agent movement patterns may be easing in some markets.

- Active Agent Pool Monitoring – The gradual decline in active agents bears watching, as it affects both the available recruitment pool and competitive dynamics.

The December AMI reading—encompassing the monthly score, seasonally adjusted index, and the trailing 12-month figures—provides vital intelligence for brokerage decision-makers as they finalize strategic plans for 2026.

ABOUT THE AGENT MOVEMENT INDEX:

The Agent Movement Index™ tracks the relative mobility of experienced real estate agents across brokerage firms using a large, national MLS sample. The index is now reported quarterly with enhanced data normalization and regional analysis, providing brokerage executives a clearer lens on long-term recruiting and retention trends.

ABOUT RELITIX:

Relitix provides data-driven decision support for brokerage leaders across the United States. A pioneer in applying AI and data science technology in brokerage management, Relitix profiles over 1.5 million agents in more than 130 markets nationwide to help brokers recruit, coach, and retain agents. Advanced data tools allow unprecedented visibility in agents, offices, and markets for strategic planning and M&A support. Learn more at www.relitix.com.