By Diana Zaya | Published April 29, 2022

What is Moneyball:

In 2002 General Manager of the Oakland A’s, Billy Beane, forever changed the way baseball teams would manage player recruitment using a concept coined as Moneyball. The concept is simple. Rather than relying on widely held conventional beliefs that valued baseball stats such as batting average, RBIs, hits, and stolen bases, Moneyball employs statistical analysis to identify undervalued players and then uses that information to construct a winning player roster. Under this theory, traditionally underwhelming stats such as ‘on-base percentage’ which is the rate at which the batter gets on base for any reason, are given more consideration than they would have been in the past.

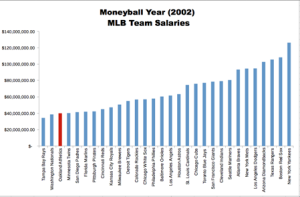

In the MLB, there are no salary caps which means that much wealthier teams such as the NY Yankees and the Boston Red Sox can afford to fill their rosters with top picks. Teams such as the Oakland A’s cannot afford such a luxury and after losing three highly valuable players in the 2002 season, Beane used his Moneyball strategy to build a player roster made up of mostly unknown or undervalued players. This risk paid off in a big way. With the third-lowest team payroll in the league, the Oakland A’s would go on to make the playoffs that year.

How does the Moneyball strategy apply to real estate agent recruitment?

Real estate companies generate massive amounts of data. Using advanced data science techniques and AI applications, that data can be converted into useful information that can then be applied in real estate agent recruitment. Since a real estate brokerage’s revenue is highly correlated to the size and quality of its agent pool, it is necessary to take an intentional approach to agent recruitment and retention. Within real estate, it is widely accepted that if you are not recruiting, you are shrinking. Typically, it is reasonable to expect that about 15%-20% of a brokerage’s annual volume will go away each year. Some of that, about 10%-12%, will be due to agents being recruited away to another brokerage. The other 5%-10% will be due to agents either retiring out of the business or leaving the business for a variety of other reasons. Most real estate leaders will acknowledge that agent recruitment should be a priority however, most are still subscribing to outdated and ineffective recruiting methods. Data science is now offering real estate leaders a smarter way to approach agent recruitment.

It has commonly been said in real estate that 20% of the agents do 80% of the business. We put this old adage to the test and while the numbers did not exactly line up this way, they were pretty close. Our data analysis showed that half of all producing agents this year will go on to sell less than $1M in real estate next year and that only 1.5% of the agent population is selling $20M+ in annual volume. It is no secret that most real estate sales are concentrated within the hands of a few ‘top producers’ and those agents are highly valued in most brokerages. However, top producers consume a large number of company resources. And, with progressive commission splits, the company dollar quickly begins to shrink when too many higher producing agents fill the office. Real estate leaders should think about what sort of agent pool is ideal to fulfill their strategic goals and how they would like the distribution of production to look.

When it comes to newer agents, much can be learned when examing the data. Newer agents represent a great opportunity for brokerages. As more senior agents retire out of the business, newer agents are invaluable for replacing that exiting volume. Additionally, they are generally easier to recruit than experienced agents and are also more likely to conform to the company culture. However, newer agents also come with much unpredictability. The reality is that most new agents entering the business today will not be around in 5 years. When we analyzed the data, we found that a newer agents volume continues to grow within their first seven years, but we also found that a large number of newer agents were exiting the business steadily each year until about year twelve. When pulling all of this data together, it suggested that the high number of departing newer agents fueled the sales volume increases of the agents that stayed. The trick is to identify those up-and-comers that have long-term potential and to do so before they become highly visible to their brokers or other recruiters. This is usually best determined at the 18-month mark when there is enough production data to make an assessment of their future potential but yet early enough that they may still be unnoticed by other recruiters in the market. Newer agents going into their second and third years of real estate have the highest propensity to make a move, further supporting the strategy of recruiting agents at this point in their careers. When sorting through the mountains of newer agents coming into the business each year, there are several metrics that can be used to determine the best recruit candidates. The most common is to look to annual production and positive YOY changes. However, there is also data that suggests that listing generation is a strong predictor of future success. Looking not only at how many listings an agent has taken but also how quickly upon entry into the MLS they took those listings can be valuable in determining who the rising stars are within any given market. At Relitix, we have developed an AI-powered metric called, ‘Rookie Rating’ that scores newer agents on their staying power and probability of future success. This algorithm has evaluated millions of newer agents on a variety of data points and helps to guide our clients to recognize up-and-comers before they are identified as top prospects within the market.

There are several other widely-held methods for measuring an agent’s value. A high list side percentage is generally thought of as a standard measurement of staying power and future success. The notion is that if you list, you last. But, aside from looking at an agent’s closed listings and list side percentage, there has not been a comprehensive way to measure a listing agent’s skill level. A long-held opinion is that being a top producer goes hand in hand with being a good listing agent. While top producing agents certainly procure many listings, it is also beneficial to survey the number of those listings that actually made it to the closing table. Also important, is considering how quickly that listing was sold and how close to the list price it was sold for. Each year, thousands of dollars are spent on marketing and supporting listings that never sell, only to go on to list with competitor brokerage. There is an actual cost to the brokerage in taking listings that expire out, so it becomes increasingly critical to measure a listing agent’s skill level. At Relitix, we have developed a machine learning model that analyzes agents on various data points and places a grade on their ability to close on the listings they take. Agents are given an A through F grade as well as indicating the dollar impact to their brokerage of this skill or lack thereof. We go a step further with our ‘Batting Average’ score which displays an agent’s 5-year listing count and the percentage of those listings that went on to sell. This insight helps leaders to better manage their agent pool as well as cultivate the right agent mix.

In 2002, the application of unconventional stats to construct a winning baseball team was a significant risk for Billy Beane and the Oakland A’s but one that came with great rewards. At Relitix, we challenge the old mindset of the way it’s always been done and continue to push the boundaries of what is possible. Delivering our clients the most innovative agent recruitment and retention tools as well as empowering them to make better-informed decisions is our passion.

For more information, please contact us at sales@relitix.com, or click below to schedule a demo.