You are on vacation and get an alert from your credit card company asking you to confirm that it was, in fact, you that just purchased a beer in Mexico. How did they decide to ask you about that? The computer models inside the credit card company’s server noted that your pattern of purchases, locations, and amounts fit a pattern similar to examples of fraudulent transactions seen in the past. This model was developed using modern machine learning techniques – essentially the computer programmed itself after observing millions of examples of fraudulent and non-fraudulent transactions and learned to recognize complicated patterns in ways a human could not.

When agents are thinking of leaving a company many begin to behave differently. Perhaps they defer taking new listings or try to close out or expire their listings ahead of schedule. This behavior is very difficult to pick out by looking at test production reports – but a computer can be trained to see those kind of patterns.

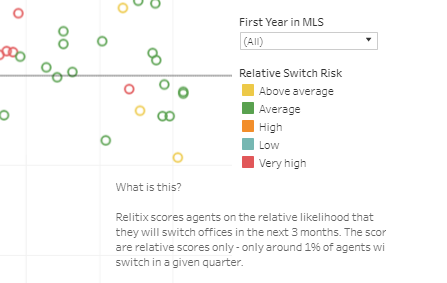

Relitix has developed a first-of-its-kind model to grade agents in a “likelihood to switch brokerages” scale. This model assigns a risk score to each agent based on how closely our models believe the agents pattern of listings, closings, and expirations matches that of agents who have switched brokerages in the past. How accurate is it? Testing reveals performance at least 8x better than random guessing.

This model will deliver a huge benefit on both the recruiting and retention side for brokerage management and we are still exploring all the potential applications. Send me an email to sign up to be a beta tester for this new advance.