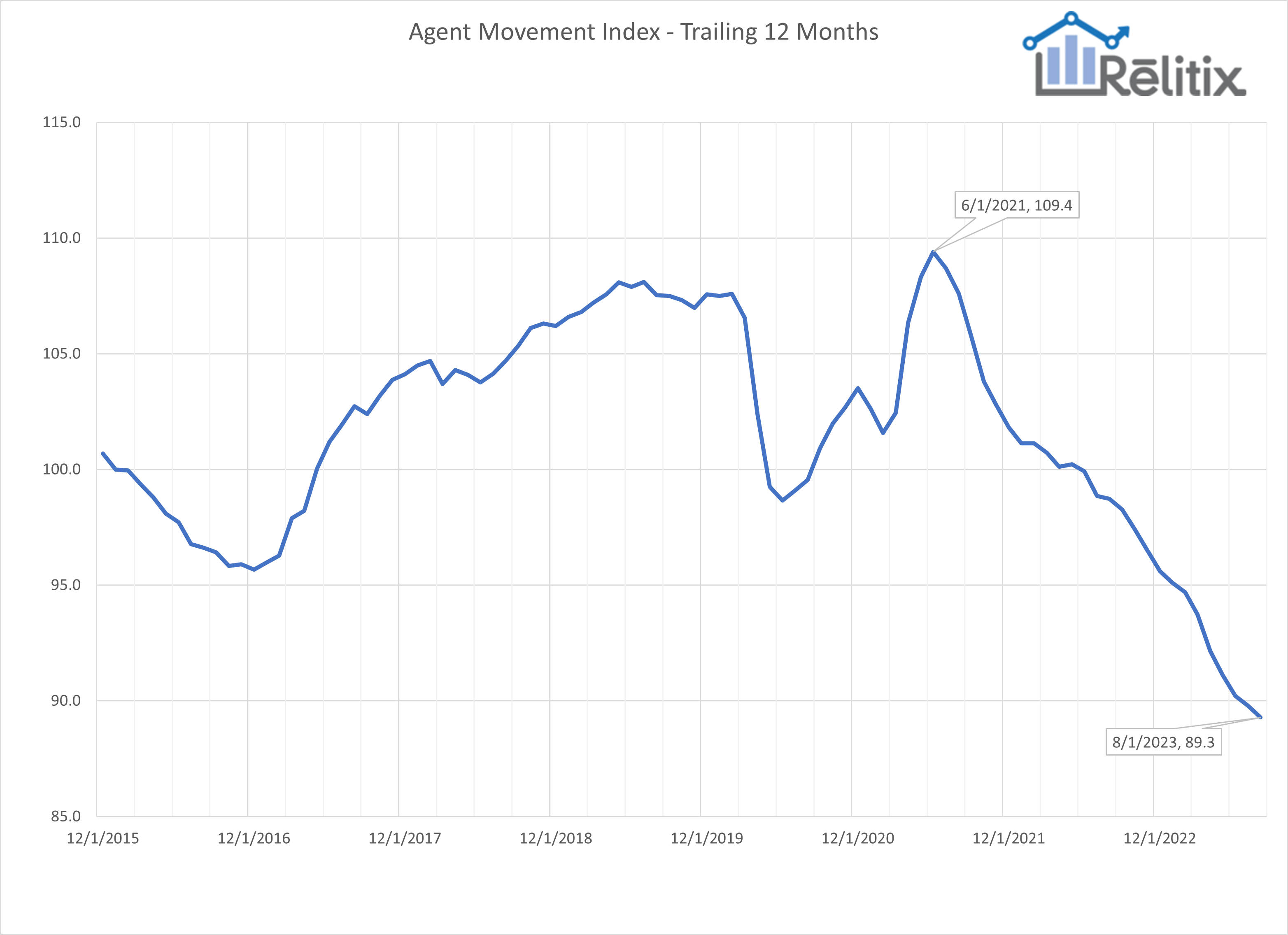

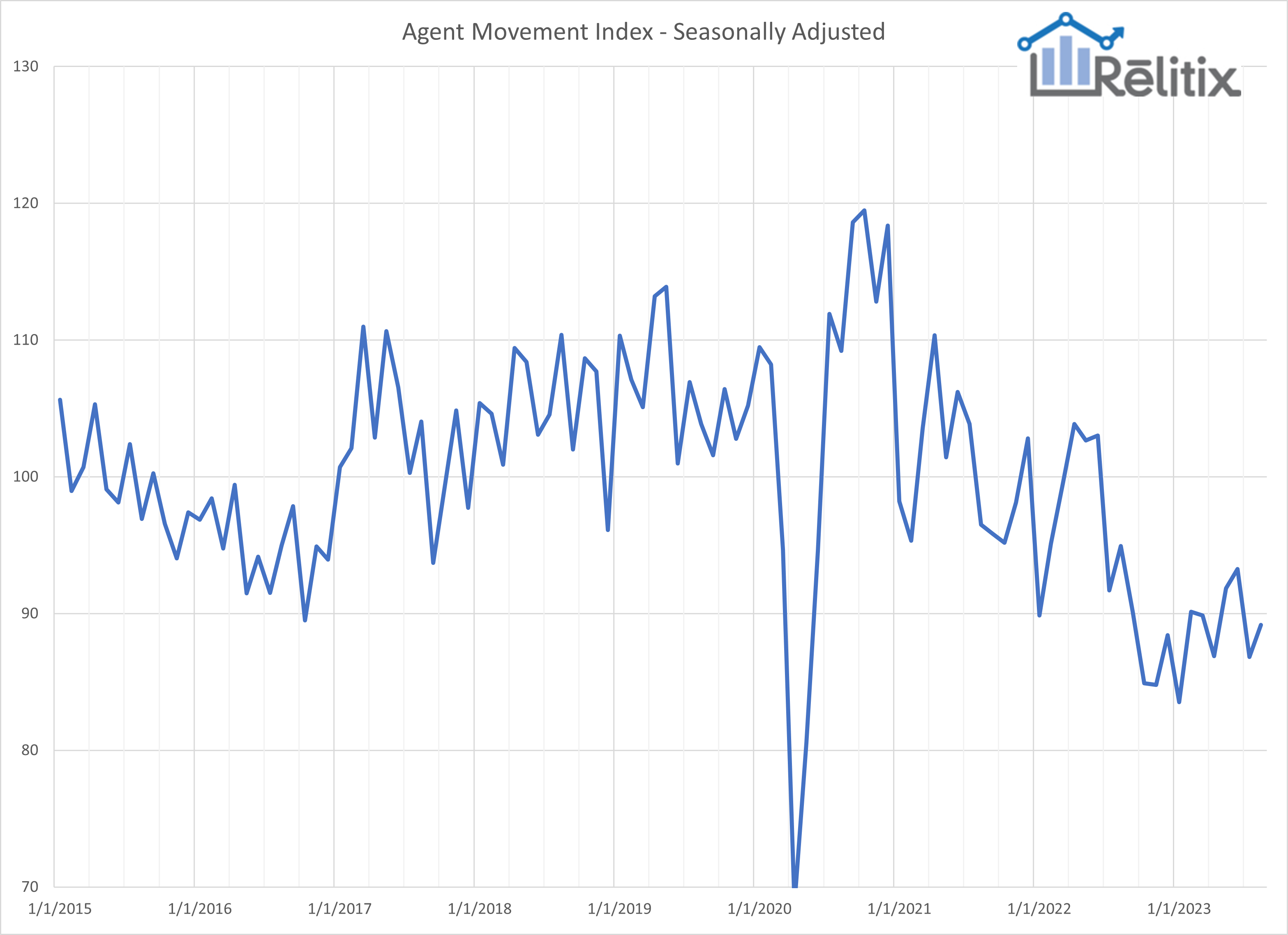

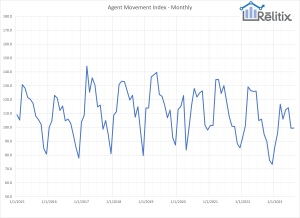

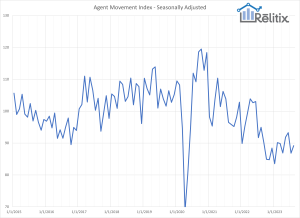

Agents are moving much less between brokerages than the post-pandemic peak seen in the summer of 2021, Relitix’s inaugural Agent Movement Index™ shows. The index shows the relative degree of movement between brokerages by experienced agents and is indexed to the level of mobility in January 2016. The graph shows that, on a trailing twelve month’s basis, mobility hit its 10-year high in June of 2021 at an index value of 109.4. The most recent trailing twelve months value shows a new low of 89.3 representing a decline in annualized movement of agents of over 18%. The seasonally adjusted values show a mild rebound beginning in January 2023.

“I think most industry players expect agent mobility to increase when the market declines. That’s not what the data is showing. Agents are reacting to an uncertain market by staying put in larger numbers. Additionally, brokerages are becoming less aggressive in expensive measures such as signing bonuses. As the market stabilizes, expect to see movement between brokerages increase”, said Relitix Founder and President Rob Keefe.

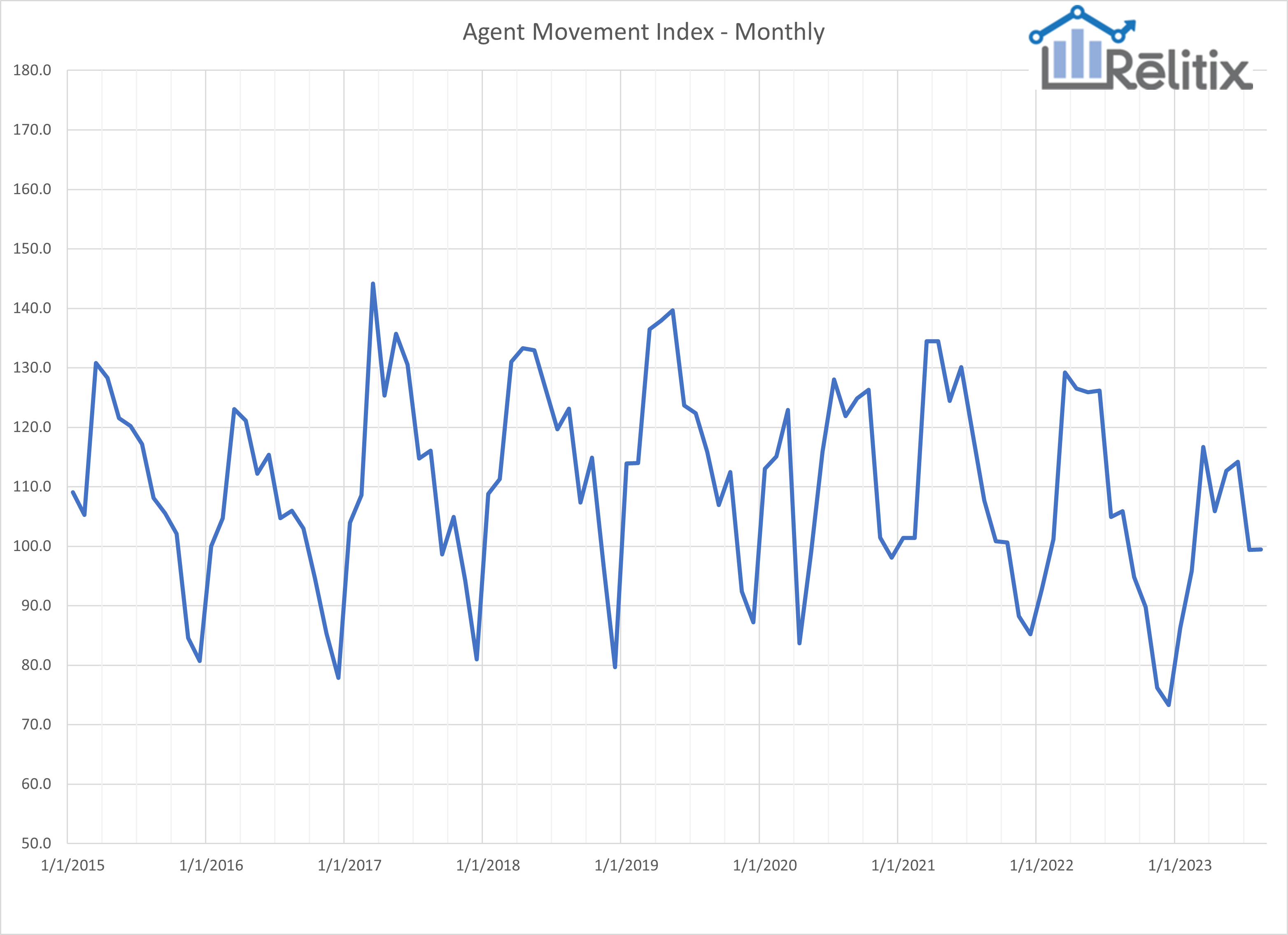

The monthly AMI value finished at 99.5 for August with a seasonally adjusted value of 89.2.

Trends in the relative movement of experienced real estate agents between brokerages is an important strategic consideration for brokerage and franchise leaders. The relative amount of movement fluctuates over time on a seasonal and long-term basis. To capture these trends and report them to the industry Relitix is proud to introduce its Agent Movement Index™. The AMI will be published monthly and feature monthly and seasonally adjusted, and 12-trailing-month values. The index is calculated using national-level data from a large sample of the nation’s most prominent MLS systems.

About the agent movement index: The agent movement reflects the relative mobility of experienced agents between brokerages. The score is computed by estimating the number of agents who changed brokerages in a given month. To be counted the agent must be a member of one of the analyzed MLS’s and change to a substantially different office name at a different address. M&A-driven activity and reflags are excluded as are new agents and agents who leave real estate. Efforts are made to exclude out of market agents and those which are MLS system artifacts. The number of agents changing offices is divided by the number of agents active in the past 12 months in the analyzed market areas. This percentage is normalized to reflect a value of 100 at the level of movement in January 2016 (0.7313%). The seasonally adjusted value divides the monthly result by the average of the same month in prior years.

Analyzed MLS’s represent over 800,000 members and include: ACTRIS, ARMLS, BAREIS, BeachesMLS, BrightMLS, Canopy, Charleston Trident, CRMLS, GAMLS, GlobalMLS, HAR, LVAR, Metrolist, MLSListings, MLSNow, MLSPIN, MRED, Northstar, NTREIS, NWMLS, OneKey, RealComp, REColorado, SEF, Stellar, Triad, Triangle, and UtahRealEstate.

Agents are moving much less between brokerages than the post-pandemic peak seen in the summer of 2021, Relitix’s inaugural Agent Movement Index™ shows. The index shows the relative degree of movement between brokerages by experienced agents and is indexed to the level of mobility in January 2016. The graph shows that, on a trailing twelve month’s basis, mobility hit its 10-year high in June of 2021 at an index value of 109.4. The most recent trailing twelve months value shows a new low of 89.3 representing a decline in annualized movement of agents of over 18%. The seasonally adjusted values show a mild rebound beginning in January 2023.

“I think most industry players expect agent mobility to increase when the market declines. That’s not what the data is showing. Agents are reacting to an uncertain market by staying put in larger numbers. Additionally, brokerages are becoming less aggressive in expensive measures such as signing bonuses. As the market stabilizes, expect to see movement between brokerages increase”.

Rob Keefe, Relitix Founder and President

The monthly AMI value finished at 99.5 for August with a seasonally adjusted value of 89.2.

Trends in the relative movement of experienced real estate agents between brokerages is an important strategic consideration for brokerage and franchise leaders. The relative amount of movement fluctuates over time on a seasonal and long-term basis. To capture these trends and report them to the industry Relitix is proud to introduce its Agent Movement Index™. The AMI will be published monthly and feature monthly and seasonally adjusted, and 12-trailing-month values. The index is calculated using national-level data from a large sample of the nation’s most prominent MLS systems.

About the agent movement index: The agent movement reflects the relative mobility of experienced agents between brokerages. The score is computed by estimating the number of agents who changed brokerages in a given month. To be counted the agent must be a member of one of the analyzed MLS’s and change to a substantially different office name at a different address. M&A-driven activity and reflags are excluded as are new agents and agents who leave real estate. Efforts are made to exclude out of market agents and those which are MLS system artifacts. The number of agents changing offices is divided by the number of agents active in the past 12 months in the analyzed market areas. This percentage is normalized to reflect a value of 100 at the level of movement in January 2016 (0.7313%). The seasonally adjusted value divides the monthly result by the average of the same month in prior years.

Analyzed MLS’s represent over 800,000 members and include: ACTRIS, ARMLS, BAREIS, BeachesMLS, BrightMLS, Canopy, Charleston Trident, CRMLS, GAMLS, GlobalMLS, HAR, LVAR, Metrolist, MLSListings, MLSNow, MLSPIN, MRED, Northstar, NTREIS, NWMLS, OneKey, RealComp, REColorado, SEF, Stellar, Triad, Triangle, and UtahRealEstate.